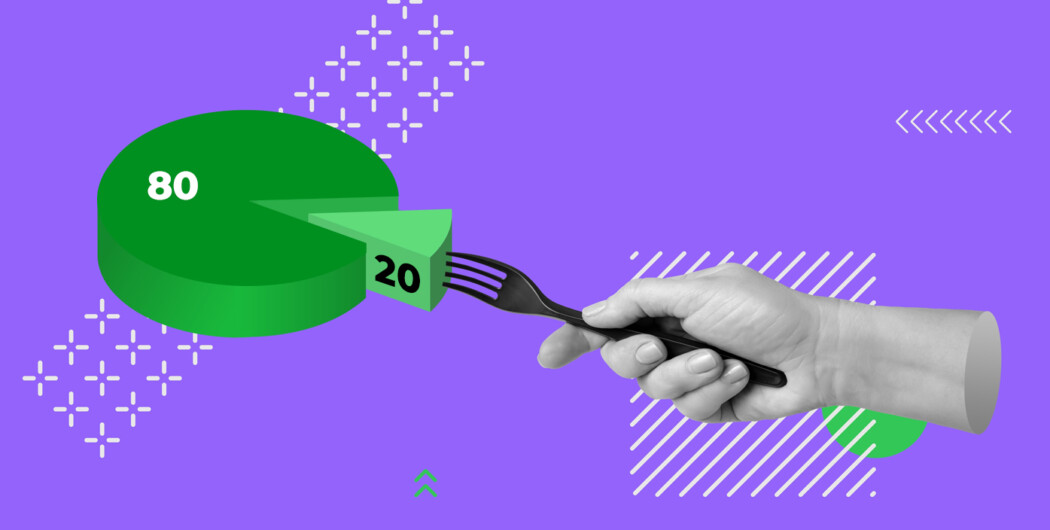

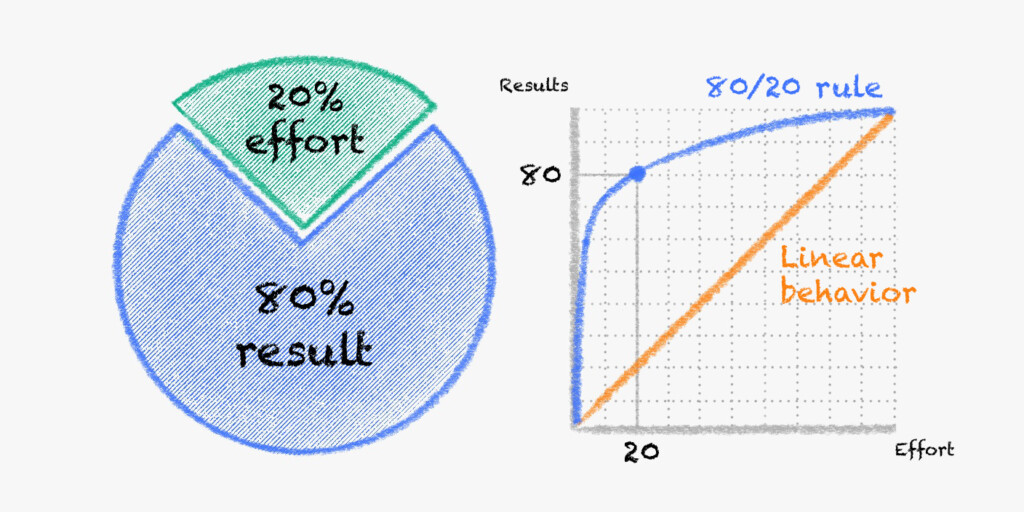

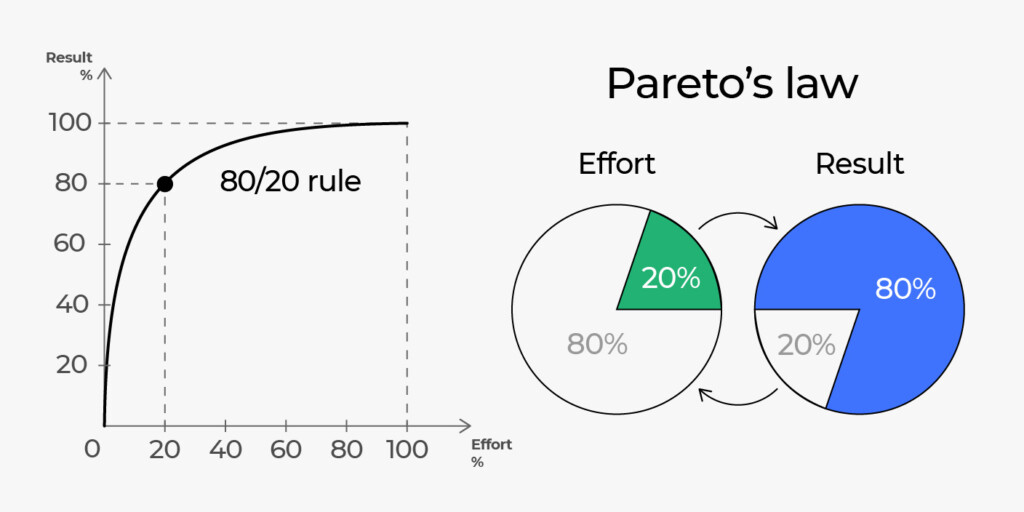

For first-year traders, the Pareto Principle is recognized as one of the most prevalent risk management theories. This principle was suggested by Joseph Juran, a man who identified the relationship between 80% of results from 20% of input.

This risk management applies to the global market, as 80% of their trading yield may result from 20% of their trading activity. In this guide, we will closely examine the fundamentals of the 80/20 rule and how it can be applied by any level of the trader to manage risk.

What is the 80/20 rule in trading?

The 80/20 rule is trendy in the foreign exchange market and is being adopted by traders. First-year traders might discover that most profit emanates from trading a particular stock or currency pair. Similarly, companies might find that most of their earnings come from about 20% of their traders or from trading a specific asset class, such as metals.

The 80/20 rule applies to a trader’s daily experience. For instance, 80% of your trading profit is realized towards the close of the day or in the morning.

How to use the 80/20 trading rule

There is a myriad of ways you can test to identify your applicable 80/20 rule as a starting trader, but below are some of the practical ways you can achieve that:

1. Multi strategy trading

If you are in your first year as a trader, it is recommended that you dedicate time to creating a trading strategy. A safe way to implement this is to trade with a demo account for strategy back-testing. Try scalping, swing trading, Elliot wave, Algorithmic trading, trend following, and dip buying.

You will discover that 80% of your trading profit will come from 20% of the total trading strategy listed above. In this case, you should focus on such techniques.

2. Asset control trading

Another way the 80/20 rule in risk balance can be identified is via the traded asset class. One common mistake with trading assets is that many traders assume that trading so many assets will bring them more profit. This is a wrong assumption! As you work on your risk balance using the 80/20 rule, you will discover that specific stocks or cryptocurrencies perform better. Your job is to identify these best performers and double down on them.

The below chart shows moderate volatility compared to other asset classes like metals and indices.

3. Trade with the right timing

The beautiful thing about the global market is that you can trade it in different time frames. As such, traders may discover that most of their profit comes during the European session followed by the American session. In the 80/20 rule, a trader should be able to identify which one holds more risk and avoid it.

When to use the 80/20 rule in risk balance

Before you open a position on the chart, consider this. The market situations below only work for some traders and trading styles but are helpful when looking for the proper implementation time.

The 80/20 rule will help out in situations:

—When you’re swing trading

—When you have a more than one profit target

—When you can access nano lots for trading

Any of the above situations presents the best ground for implementing this rule and promises the best yield.

Final thoughts

The 80/20 rule is fundamental in managing risk, especially for first-year traders yet to get the hang of the global markets’ technicality. This trading rule helps correctly identify stocks or underlying assets with potential risk or profit. Similarly, traders can learn strategies that perform well under varying market conditions. It is imperative to adopt the 80/20 rule when you are looking for the best way to maximize your investment as a first-year trader.

Sources:

DayTrade The World: MAXIMIZE PROFITS WITH THE 80-20 RULE WHEN DAY TRADING

Trading Heroes: How the 80/20 Rule Can 2X Your Current Trading System