There’s money to be made in unplanned scenarios. Ben Bernanke tripled the Fed’s balance sheet to absorb a depression in the financial system. Carl Icahn proved that he knew market peaks and troughs—when he bought three Las Vegas properties during financial hardships and sold them at a hefty profit when the market recovered.

But even these investors wouldn’t recommend counting on financial crises to make money. That could lead you to a path of impulsive trading. Every trader, beginner or advanced, should follow a systematic methodology for choosing assets, entering and exiting, determining the position size, etc. An essential part of your trading methodology should be money management.

For those who’ve heard all about basic money management, this article has prepared a few lesser-known tactics.

1. Fixed fractional system

The fixed fractional system ensures that position sizing is proportional to the level of risk. A riskier trade should be smaller, and a less risky trade should be bigger. By trading along with the potential value of losses and gains, you can limit losses and pick up more from the wins.

2. Fixed-ratio system

The fixed-ratio system is similar to the previous money management method. Only this time, the calculations are based on accumulated profit. So, you pick a certain amount of profit to achieve before you trade with a higher position size.

The system is meant to protect your accumulated profits while increasing your exposure to the market.

3. Kelly criterion formula

The Kelly criterion is based on your previous trades. It tells you how much you should put into a new trading position by taking into account your similar trades in the past. For better results, it’s recommended to provide data for over 100 trades.

Kelly % = Win percentage – [(1 – Win percentage) / Win to loss ratio]

Thus, you will find out your maximum amount per trade. You can trade a lower amount if you want to be more conservative; what’s more important is that you don’t trade more.

4. Optimal F

Optimal F is another way of determining your ideal trade size based on the biggest loss from a set period.

N = (F * Equity / risk) / Price

To keep track of your calculations, consider using a spreadsheet. The percentage changes with every trade, so you’ll be dealing with a lot of numbers.

This system is stricter than other ones: if your Optimal F is 8%, each trade should be 8% of your account; no more, no less.

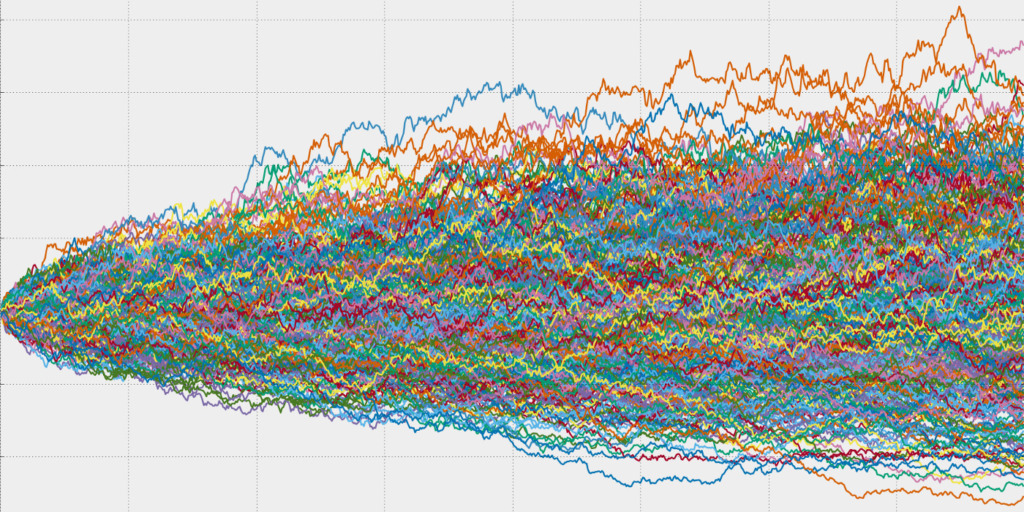

5. Monte Carlo simulation

The Monte Carlo simulation is a computer program that is based on the assumption your future performance can be derived from your past trades. The simulation will tell you the likelihood of total loss and calculate your optimal trade size. The probability distributions will be based on your inputs.

Bear in mind that a computer can’t account for every possible thing, so consider it as assistance for measuring trades.

6. Martingale system

According to the system, you will make up for all your losses if you double the trade size each time the previous trade becomes a loser. If the next trade is successful, you should go back to the initial trade size.

The method works best for aggressive traders because a long enough losing streak will put your entire account at risk. It also requires you to have large trading capital.

How does money management affect trading results?

No matter how technically skilled a trader is, money management will impact their career longevity the most. It won’t directly increase your profits. But it will do something even more important: it’ll help you preserve your trading capital. If you want to be able to absorb financial losses and crises like Ben Bernanke, money-management techniques are a must.

The concept of money management is closely linked to risk management. So, make sure to also consider, prepare for, and manage all identifiable risks.